Share

Easy Steps for Seniors to Eliminate Debt

Dealing with debt can be tough for consumers of any age group, however that is especially the case for seniors. At The Debt Relief Company, we help Americans eliminate high-interest credit card debt and save money on their credit card debt. With the cost of living ever increasing rising and inflationary pressure constantly on the rise, many consumers can find themselves in a financial bind. This guide is here to help! Our goal is to provide straightforward steps to help seniors tackle their debt and regain a sense of financial freedom in their golden years. Whether it's understanding your debt situation or finding ways to better manage it, we've got you covered.

📊 "An October 2023 AARP study found that 65% of people aged 65 and older who have debt consider it a problem, including 29% who call it a major problem." Source

Why Seniors Face Debt Issues

Seniors face debt issues for all types of reasons but most commonly, senior relate debt occurs from:

- Rising medical expenses that generally don't keep up with inflation adjusted income.

- Unexpected home repairs that don't keep up with inflationary pressures.

- Helping out family when they might not be in the best position financially.

Why just the other day my elderly neighbor (who lives by herself) got hit with a unexpected episode of mold seeping into her home basement. Thankfully, she is mobile and tends to herself to the best of her abilities (for her age), but she was ill equipped to handle this unexpected life happening. Put in the same scenario, many seniors have to opt in to choosing "live with mold" or "charge the expense to a credit card". It's not always a easy decision to make, especially when your on a fixed income. Now this is just one anecdote but hundreds of thousands of seniors throughout the country are going through similar situations and when you income is fixed, your options to manage unexpected expenses are limited.

Benefits of Tackling Debt

- Financial peace of mind

- More money for life necessities

- Better quality of life and less stress

Besides these obvious benefits, tackling and eliminating debt also has a much needed psychological reward. Living with debt overhead is not a good feeling!

Steps to Get Started

The best way to get started is by listing all your debts and writing everything down on paper or putting it on your computer. Once you have completed listing your debts and sources of income, you'll want to total everything out and find out how much your left with at the end of each month. Feel free to make use of our monthly budget calculator to make the process of totaling your income and expenses easier.

- List all your debts (and their subsequent monthly payments)

- Total your income and expenses in an attempt to understand your finances

- Weigh options for cutting expenses or alternatives to generating extra income

Understanding Senior Debt

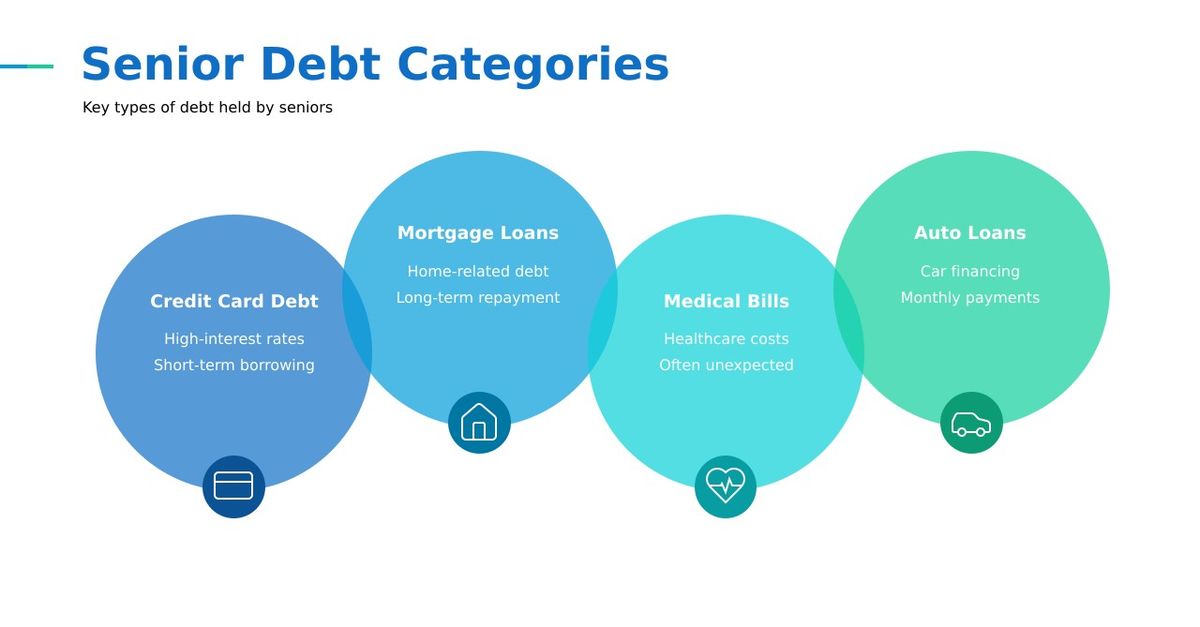

Common Sources of Debt Among Seniors

- Credit Card Debt: Many seniors rely on credit cards for everyday living expenses, leading to high balances and high interest rates.

- Medical Bills: Unexpected medical expenses can quickly add up, this is especially the case if your insurance doesn't cover all expenses.

- Mortgage and Home Equity Loans: Many seniors still carry mortgage debt or have even taken out home equity loans to better manage expenses and debts.

- Car Loans: Even in retirement, car payments can be a significant burden fro many seniors. Car notes often weigh heavily on their budgets.

Why Debt is Increasing in Older Age Groups

- Rising healthcare costs have continued to outpace growth in income and healthcare is a great source of inflationary pressure especially for seniors. Although social security income is adjusted via inflation, the real cost of inflationary pressures is not always captured via these adjustments/increases.

- Many seniors do not have sufficient retirement savings and are therefore forced to rely heavily on credit. It's not something that anyone wants to do but it's unfortunately what tends to happen when seniors are left with no other options.

- Many seniors are the first to reach out and attempt to help family members when a financial need arises! Children and grandchildren are usually their first priority. However, when the tables are turned this sadly isn't always the case. American culture does not value the elderly as much as it should Please always remember to watch over your grandparents and take care of the elderly!

📊 30% of Americans over 75 carried credit card debt in 2022, a 200% increase from 10% in 1989. Source

Types of Debt Commonly Held by Seniors

Understanding the landscape of senior debt is crucial for developing strategies to help manage and effectively reduce it. By recognizing the common sources and reasons for increasing debt, seniors can take proactive steps to address their financial challenges in the present. However, this won't just "happen", steps need to be taken!

Assessing Your Financial Situation

Understanding your financial situation is the first step towards eliminating debt. If you don't have a clear picture of where you stand and haven't analyzed your current financial situation it's pretty tough to move forward with a sound plan of action.

Creating an Inventory of Debts

List All Your Debts: Write down every single debt you have. This includes credit cards, mortgages, medical bills, and any other loans. Make sure to note the balance, interest rates, and minimum monthly payment or installment payments for each debt.

Prioritize Your Debts: Decide which debts require the most urgency. You will want to focus on those with the highest interest rates first, as they'll cost you more in the long term. Credit cards and other revolving debts tend to have the highest interest rates.

Organize Your Information: Organize your debt information and accounts by putting them onto an excel spreadsheet or in a notebook. This way, you can easily track your progress as you pay them down month by month.

Evaluating Income and Expenses

- Track Your Income: Make a list of all your income sources, such as Social Security income, pensions, and part-time wages. Knowing exactly how much money you have coming in each month is crucial to effectively evaluating your income and expenses.

- List Your Expenses: Write down all your monthly expenses. This includes essentials like housing and food, as well as non-essentials like dining out and other monthly subscriptions. Try to include as much as possible, even one-off expenses that might not be reoccurring.

- Compare and Adjust: Compare your income to your expenses. If your monthly expenses exceeds your income, you're in the red and you need to look for areas where you can cut back. This might involve reducing non-essential spending or finding ways to increase your monthly income.

Setting Financial Goals

Setting financial goals is a crucial step in managing your finances effectively. Start by defining clear and realistic objectives that align with your current financial situation and future aspirations. Whether it's paying off a specific debt, saving for a vacation, or building an emergency fund, having a target in mind gives you something to work towards. Write down your goals and break them into smaller more manageable steps. This approach not only makes them less overwhelming but also allows you to track your progress a lot easier. Remember, the key is to be realistic about what you can achieve within a certain timeframe, considering your income and expenses.

Exploring Debt Elimination Strategies

Eliminating debt can feel like a huge to-do, but there is always hope and there are multiple strategies that can help make it more manageable. Whether your consolidating your debts, negotiating with creditors on your own, or enrolling in a debt relief program understanding your options is key. Here's a look at some practical steps seniors can take to reduce or eliminate their debt.

Debt Consolidation Options

Debt consolidation can be a useful strategy for seniors looking to simplify their monthly debt payments. By combining multiple debts into one, you can often secure a lower interest rate or a more manageable payment plan. Here are a few options:

- Personal Loans: These can be used to pay off high-interest credit cards, allowing you to focus on a single payment with a potentially lower interest rate. With this option your monthly payment will usually be quite high and you'll also pay an origination fee.

- Balance Transfer Credit Cards: Some credit cards offer low or promotional 0% interest offers on balance transfers for a limited time. This can be a great way to pay down debt without accruing additional interest. Don't forget that if you pay a 4% transfer fee, you are essentially making an upfront interest payment.

- Home Equity Loans: If you own your home, you might consider a home equity loan to consolidate your debt. This option often offers lower interest rates but comes with the risk of losing your home if you default. They have also become a lot more rare in recent years and are finally now beginning to creep past their covid lows according to an article from Bankrate.

Negotiating with Creditors

Sometimes, simply taking the time to reach out to your creditors can lead to better terms. Here are some tips to help do so:

- Explain Your Situation: Be honest about your financial situation. Creditors may be more willing to work with you if they understand the life challenges your facing.

- Request Lower Interest Rates: Ask if they can reduce your interest rate or offer a temporary hardship plan. Most creditors should at the very least discuss some hardship offerings with you.

- Explore Settlement Options: In some cases, creditors might agree to settle your debt for less than the full amount if you can pay a lump sum. You can do this on your own or with a debt settlement company.

Debt Management Plans

Debt Management Plans (DMPs) are structured programs designed to help individuals pay off their debts over time. These plans are typically offered by nonprofit credit counseling agencies and can provide a roadmap to becoming debt-free. Here's how they work:

- Assessment and Counseling: First, you'll meet with a credit counselor who will assess your financial situation. They'll help you understand your debts and create a budget that fits with your lifestyle.

- Creating a Plan: Based on your assessment, the counselor will develop a personalized debt management plan. This plan will consolidate your unsecured debts into a single monthly payment, which is then distributed to your creditors.

- Creditor Negotiation: The counselor will negotiate with your creditors to potentially lower interest rates, waive fees, or extend payment terms. This can make your monthly payments more manageable and help you pay off your debt faster.

- Sticking to the Plan: Once the plan is in place, it's important to make your payments on time each month. The counseling agency will distribute the payments to your creditors, ensuring that your debts are being paid off as agreed.

Participating in a DMP can also positively impact your credit score over time, as consistent payments demonstrate responsible financial behavior. However, the enrolled accounts might get notated as being worked on with a "debt management plan", some lenders could potentially see this as a blemish. It's also important to note that while enrolled in a DMP, you may be advised to avoid taking on new lines of credit to ensure your successful completion of the program.

Debt Settlement

Many seniors should consider debt settlement as a viable option in helping them eliminate their credit card debt. If you are comparing debt management vs debt settlement, then debt settlement takes the cake in terms of helping seniors save the most money possible. Debt management is okay for someone consumers but most consumer will likely see the most savings and most benefit from a debt settlement option. Seniors will be able to effectively reduce the principal amount they owe and get out of debt within a 2 to 4 year time frame. Credit card accounts will have to be closed and their will be a short term negative impact to their credit but they will eventually become more credit worthy overtime as they pay down their accounts. Moreover, most seniors might not be making major purchases and have the utmost need for their credit score. So, for many of them, saving money each and every month is much more valuable to their day to day lives. There are some associated negatives with debt settlement as principal savings could be subject to taxes, but for the most part it is a well-rounded option that could help seniors stop wasting money on interest payments every month.

Leveraging Home Equity

For many seniors, your home is your most valuable asset. Over the years, as you've paid down your mortgage, you've most likely built up equity in that home. You can utilize that equity to help shuffle around you debt at a lower interest rate but there is definitely some inherent risk associated with doing this. Here are some alternative ways to use that equity to your advantage.

Reverse Mortgages

A reverse mortgage allows seniors aged 62 and older to convert part of their home equity into cash. Unlike a traditional mortgage, you don't have to make monthly payments. Instead, the loan is repaid when you sell the home, move out, or pass away. This can help provide a steady income stream or a lump sum to pay off high-interest debts. However as with any option, there are associated pros and cons of doing so.

- No monthly payments required

- Stay in your home as long as you live

- Use funds for any purpose, like paying off debt

It's important to understand that reverse mortgages can reduce the equity in your home and affect the inheritance you leave behind. Many seniors may oppose this option but it is something you might consider as a "last resort". However, like anything else you can consider

Downsizing or Selling the Home

Another option is to sell your house and move to a smaller, more affordable home. This can free up cash to pay off debts and reduce ongoing expenses like property taxes and maintenance. Here's how it can help:

- Eliminate Mortgage Payments: By selling your home, you can pay off your remaining mortgage balance and potentially have a lot of extra funds to designate towards paying down other debts.

- Lower Living Expenses: Moving to a smaller downsized home or a senior community can significantly reduce your monthly expenses. However, would be a big lifestyle change for many and might be a difficult life adjustment.

- Increase Financial Flexibility: The proceeds from selling your home can be used to create an emergency fund or invest in income-generating assets.

Considerations for Using Home Equity

Reverse Mortgages - You won't have monthly payments and you get to live in home. However this reduces home equity and highly affects the odds of you leaving anything behind for your children.

Downsizing - This option helps lower living expenses and can help you pay off debts. However, there is definitely an associated emotional impact of moving to a smaller space and moving means change.

Leveraging home equity can be a smart way to manage debt, but it's important to carefully weigh the pros and cons. Consider speaking with a financial advisor to explore all your options so you can make the absolute best decision for your particular situation.

Budgeting and Expense Reduction

Creating a budget and reducing expenses can significantly help seniors manage their debt. By understanding where your money goes each month, you can make informed decisions to cut back on unnecessary spending and allocate more funds towards debt repayment.

Cutting Non-Essential Spending

- Identify Unnecessary Expenses: Take a close look at your monthly spending and identify areas where you can cut back. This might include dining out, subscriptions, or other luxury purchases.

- Prioritize Needs Over Wants: Focus on spending money on essentials like groceries and healthcare, and limit spending on non-essential items whenever possible.

- Use Cash Instead of Credit: Paying with cash can help you stick to your budget and avoid accumulating more debt. It also can be a good idea to use cash for certain categories of your budget like groceries for example.

Increasing Income

- Part-Time Work: Consider taking on a part-time job or some extra freelance work to boost your income. This extra money can be put towards paying off debt.

- Sell Unused Items: Look around your home for items you no longer need and sell them online or at a garage sale. Even just selling a few unwanted items a month could make a big difference.

Utilizing Senior Discounts

- Take Advantage of Discounts: Many stores and services offer discounts for seniors. Make a list of these and use them whenever possible to save money.

- Discount Programs: Look into programs that offer discounts on essentials like groceries and prescription medications. Select retail stores also offer senior discounts.

- Public Transportation: Use senior discounts on public transportation to save on travel costs. If you travel with the MTA or any other mode of public transportation, you can receive a senior discount.

Some stores have senior discounts you might be unaware of. The least you can do is ask. Never be too shy or too afraid to ask!

Steps to Reduce Expenses

Cut Cable TV - You could potentially save $50 a month or more if you switch to streaming services.

Use Public Transportation - You could potentially save hundreds a month if instead of driving you took the bus more often and utilized senior discounts.

Grocery Shopping with Coupons - You could potentially save $100 or more a month if you used store coupons and went grocery shopping on discount days.

By following these steps, seniors can create a budget that works for them, reduce their expenses, and make a more impact to their debt. It's really all about making small changes that add up over time!

Avoiding Scams and Predatory Practices

Recognizing Debt Relief Scams

It's important for seniors to be aware of debt relief scams that promise quick fixes or guaranteed solutions. These scams often target those who are desperate to eliminate debt. Here are some red flags to watch out for:

- Requests for upfront fees before any services are provided

- Lack of transparency about the services offered

- Pressure to act immediately without giving you time to review options and think it over

If something sounds too good to be true, it probably is. Always research the company and read reviews before agreeing to any services. Research is your best friend when helping you to decide.

Safeguarding Personal Information

Protecting your personal information is crucial in avoiding scams and predatory practices. Here are some tips to keep your information safe:

- Never share your Social Security number or bank details with unknown callers or spammy emailers.

- Use strong, unique passwords for online accounts and try your best to change them regularly.

- Be cautious of emails or messages that ask for personal information, even if they appear to be from trusted sources.

- Regularly check your bank statements and credit reports for any unauthorized transactions.

Always try to bear on the side of caution whenever you get an unsolicited emails.

Common Signs of Predatory Practices

Unsolicited Offers - Calls or emails offering debt relief out of the blue. Hang up the call or delete the emails and make sure not to provide them with any info.

High-Pressure Tactics - Urgency to sign up for a service immediately. Take your time to research the company on the internet and consult with any advisors you might have.

Upfront Fees - Requests for payment before any service is rendered. Walk away and report to consumer protection agencies. None of these companies are supposed to take any upfront fees.

Being informed and cautious can help you avoid falling victim to scams and predatory practices. It's always a good idea to consult with a trusted financial advisor or counselor before making any decisions related to debt relief.

Seeking Professional Help

Sometimes, managing debt on your own can feel overwhelming. That's when seeking professional help can make a big difference. Whether it's working with a financial advisor or consulting a nonprofit credit counselor, getting expert guidance can provide a clear path to debt elimination and financial freedom. And financial freedom should ideally be the goal for all seniors as they retire in peace!

Working with a Financial Advisor

A financial advisor can offer personalized advice tailored to your specific situation. They can help you:

- Develop a realistic budget

- Explore debt consolidation options

- Plan for long-term financial goals

It's important to choose an advisor that understands the unique challenges seniors face. Look for someone with experience in retirement planning and debt management and go from there.

Consulting Nonprofit Credit Counselors

Nonprofit credit counselors can provide valuable assistance at little or no cost. They can help you create a debt management plan (DMP) and negotiate with creditors on your behalf. Here's what to expect:

- Initial Consultation: You'll discuss your financial situation and goals with a counselor.

- Debt Assessment: The counselor will review your debts and suggest different solutions and options.

- Ongoing Support: You'll receive guidance and support as you work towards achieving a debt-free future.

Working with a nonprofit credit counselor can be a great way to get back on track financially. They offer practical solutions and support to help you manage your debt effectively.

Options for Professional Debt Help

Financial Advisor - Personalized advice, long-term planning. May involve fees, choose carefully.

Nonprofit Credit Counselor - Low-cost or free, helps with DMPs. Ensure they are reputable, check credentials.

Seeking professional help is a smart step towards managing debt. It provides the guidance and support needed to navigate complex financial situations, ensuring you make informed decisions that align with your goals.

Benefits of Eliminating Debt for Seniors

Getting rid of debt can really be a game-changer for helping seniors achieve a better quality of life. It's not just about the numbers; it's about feeling secure and enjoying life more. Here are just some of the few perks you can look forward to once you're debt-free.

Improved Mental Health

Debt really can be a huge source of stress for many of our nation's elderly so much so it can lead to debt depression. Worrying about payments and interest rates can take a big toll on your mental well-being. By eliminating debt, you can breathe easier and enjoy a more peaceful life. No more sleepless nights over financial worries!

Enhanced Financial Security

Without debt hanging over your head, your monthly income will go that much further. You can save more money each month, invest in things that matter, or just have a better financial cushion for unexpected expenses. Just think what you would be able to do with all that extra cash!

Greater Freedom in Retirement

Imagine retiring without debt. You could travel, pick up new hobbies, or simply spend more time with family and friends. Being debt-free means you would have less money going towards interest and could start living the retirement you've always dreamed of.

📊 The median debt of senior-led households was $34,000 in 2023, highlighting the importance of addressing debt for a secure retirement. Source

Key Benefits of Eliminating Debt

Benefits

- Improved Mental Health

- Enhanced Financial Security

- Greater Freedom in Retirement

Impact

- Reduced stress and anxiety

- More savings and better budgeting

- Ability to enjoy activities and hobbies without financial constraints

Getting rid of debt is a major step towards a happier, more secure life. It's not just about money; it's about giving yourself the freedom and peace of mind you deserve. So, take the steps today to start reducing your debt and enjoy these amazing benefits.

Avoiding Future Debt

Building an Emergency Fund

One of the best ways to avoid future debt is by setting up an emergency fund. This fund acts as a safety net for when unexpected expenses arise, like medical bills or car repairs. Aim to save at least three to six months' worth of living expenses. Start small if needed, and gradually increase your savings over time. Keep this money in a separate, easily accessible account to ensure it's there when you need it.

Living Within Your Means

Living within your means is crucial to staying debt-free. Create a budget and make sure to stick to it! Always try to prioritize needs over wants and avoid using credit cards for unnecessary purchases. If you can't pay off your credit card balance each month, it's probably a sign that you're spending beyond your means. Interest is not your friend! After everything is all said and done, you might still need adjust your living expenses and cut costs wherever possible.

Educating Family Members

It's important to educate family members about your financial boundaries. Many seniors fall into debt by helping out relatives when they might not be in the best financial position themselves. Have open discussions about what you can and cannot afford to contribute. Setting clear boundaries can prevent future financial strain and ensure that your family understands your limits.

Steps to Prevent Future Debt

Build an Emergency Fund - Avoid unexpected debt - Start small, aim for 3-6 months of expenses built up.

Live Within Your Means - Maintain financial stability - Create and stick to a budget, prioritize needs over wants.

Educate Family Members - Prevent financial overreach - Set clear boundaries on financial help with family members.

Avoiding future debt is not just about managing your finances today but also about planning for tomorrow. By taking these steps, you can ensure a more secure and stress-free financial future.

Frequently Asked Questions

What are the best ways for seniors to consolidate debt?

Seniors can consolidate debt through various methods such as balance transfer credit cards, personal loans, or home equity loans. Each option has its pros and cons, so it's important to evaluate which one best fits your financial situation. Consulting with a financial advisor can also provide guidance tailored to your needs.

How can seniors negotiate with creditors?

Negotiating with creditors can involve requesting lower interest rates, setting up a payment plan, or even settling for a reduced amount. It's helpful to communicate openly about your financial situation and try proposing a realistic plan. Credit counseling services can also assist in negotiating with creditors on your behalf.

Is a reverse mortgage a good option for seniors with debt?

A reverse mortgage can be a viable option for seniors who have significant home equity and need to eliminate debt. These options allow you to convert home equity into cash without monthly payments. However, it's important to understand the terms and implications, as it may affect your estate and future housing plans.

How can seniors avoid debt relief scams?

To avoid debt relief scams, seniors should be cautious of companies that promise quick fixes or ask for upfront fees. Always verify the legitimacy of the company, read reviews, and consult with trusted financial advisors. Nonprofit credit counseling agencies are generally a safe bet.

What steps can seniors take to prevent future debt?

Preventing future debt involves creating a sustainable budget, building an emergency fund, and living within your means. Educating family members about your financial boundaries can also help. Regularly reviewing your financial plan and adjusting it as needed can keep you on track.

Why Choose The Debt Relief Company for Eliminating Your Debt?

At The Debt Relief Company, we specialize in helping Americans eliminate high-interest credit card debt and save money. Our experienced team provides personalized debt relief solutions tailored to your unique financial needs.

With a proven track record of assisting countless individuals in achieving financial freedom, you can trust us to guide you towards a debt-free future.

Frequently Asked Questions

What are the best ways for seniors to consolidate debt?

Seniors can consolidate debt through various methods such as balance transfer credit cards, personal loans, or home equity loans. Each option has its pros and cons, so it's important to evaluate which one fits your financial situation best. Consulting with a financial advisor can also provide guidance tailored to your needs.

How can seniors negotiate with creditors?

Negotiating with creditors can involve requesting lower interest rates, setting up a payment plan, or even settling for a reduced amount. It's helpful to communicate openly about your financial situation and propose a realistic plan. Credit counseling services can also assist in negotiating with creditors on your behalf.

Is a reverse mortgage a good option for seniors with debt?

A reverse mortgage can be a viable option for seniors who have significant home equity and need to eliminate debt. It allows you to convert home equity into cash without monthly payments. However, it's important to understand the terms and implications, as it may affect your estate and future housing plans.

How can seniors avoid debt relief scams?

To avoid debt relief scams, seniors should be cautious of companies that promise quick fixes or ask for upfront fees. Always verify the legitimacy of the company, read reviews, and consult with people you trust. Nonprofit credit counseling agencies are generally a safe bet.

What steps can seniors take to prevent future debt?

Preventing future debt involves creating a sustainable budget, building an emergency fund, and living within your means. Educating family members about your financial boundaries can also help. Regularly reviewing your financial plan and adjusting it as needed can keep you on track.

Whatever option you decide to go with, try to make the most informed decision possible and try to do what is absolutely best for your particular situation! Finally, try take care of your debt while you are still in good health so you don't have to ask questions like what happens to credit card debt when you die?