Share

Bankruptcy vs Debt Relief: Which is Right for You?

This is probably the most consequential financial decision you'll make if you're reading this article. And I want to be careful with it, because I've seen people get steered in the wrong direction by companies that have a financial interest in the answer.

I run a debt settlement company, so I obviously have some skin in the game. I'll be upfront about that. But I also refer people to bankruptcy attorneys fairly regularly when settlement isn't the right fit. I'd rather give you honest advice and earn your trust than sign you up for a program that won't work for your situation.

Here's how I think about this decision after seven years of helping people through it.

The Core Difference

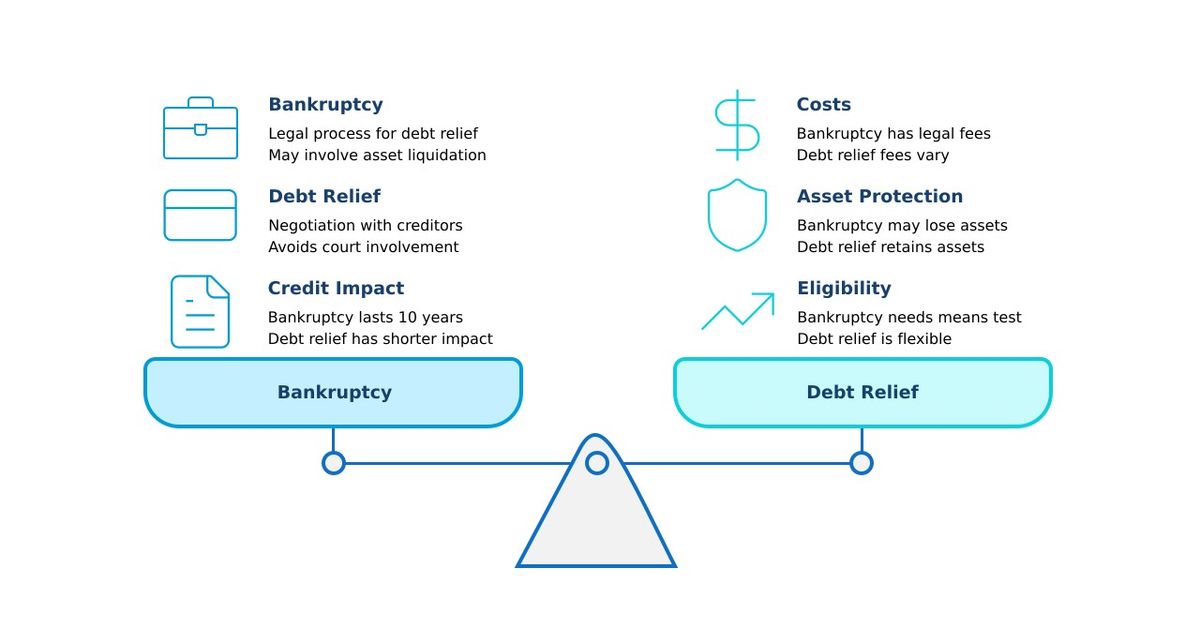

Bankruptcy is a legal process through the courts. A judge reviews your situation and either wipes out your eligible debts (Chapter 7) or puts you on a court-supervised repayment plan (Chapter 13). It's comprehensive, it's legally binding, and it has the most significant long-term consequences.

Debt settlement is a private negotiation. My team contacts your creditors and works out deals to pay less than what you owe. There's no court involvement, no judge, no public record. You approve each settlement individually, and the process typically takes 12 to 48 months.

Both can get you out of debt. But they do it in fundamentally different ways, with different costs, different timelines, and different impacts on your life.

When I Tell People to Talk to a Bankruptcy Attorney

I mean this literally — there are consultations where I tell the person sitting across from me (or on the phone) that they should be calling a bankruptcy lawyer, not enrolling in our program. Here are the situations where I do that.

The debt is truly unsurvivable. If someone owes $150,000 on a $50,000 income with no assets, settlement math doesn't work. Even at 50% settlement, they'd need to come up with $75,000 plus fees. That's not realistic. Chapter 7 could discharge all of it for the cost of an attorney ($1,500 to $3,500) and a filing fee.

They're being sued right now and need immediate protection. When you file bankruptcy, something called an "automatic stay" goes into effect immediately. Every creditor must stop all collection activity — calls, letters, lawsuits, wage garnishment — the instant that filing hits. Nothing in debt settlement provides that kind of instant legal shield. If someone has a garnishment hitting their paycheck next week, they need a bankruptcy attorney today.

They qualify for Chapter 7 and have mostly unsecured debt. Chapter 7 is incredibly efficient for the right candidate. If your income is below your state's median and your debts are primarily credit cards and medical bills, Chapter 7 can wipe the slate clean in 3 to 6 months. The credit damage is severe but the speed and comprehensiveness are unmatched.

They've already tried settlement or other options and nothing has worked. Sometimes I talk to people who've been struggling for years — trying to keep up with payments, attempted consolidation that fell through, tried negotiating on their own. At some point, the most compassionate advice is to stop fighting a losing battle and use the legal system designed for exactly this situation.

When Settlement Makes More Sense

Now here's where our program shines — and why most of our clients choose settlement over bankruptcy.

They have $15,000 to $75,000 in unsecured debt with steady income. This is our sweet spot. The debt is too much to manage through minimum payments or consolidation, but it's not so overwhelming that only bankruptcy can address it. They can afford monthly deposits of $400 to $1,500 into a dedicated account, and the math works for settling everything within 24 to 36 months.

They want to avoid the public record. Bankruptcy filings are public. Employers, landlords, business partners — anyone — can find them. I've had clients who specifically couldn't file bankruptcy because of their profession. People in financial services, people with security clearances, business owners who need to maintain credit relationships. Settlement is entirely private. It shows on your credit report as settled accounts, but there's no court filing for anyone to discover.

They want control over the process. In bankruptcy, a judge and a trustee make decisions about your financial life. In settlement, you approve every deal individually. If you don't like a settlement offer, we don't take it. If you want to prioritize one account over another, we can discuss strategy. You're in the driver's seat.

Their credit matters in the near term. I won't sugarcoat it — settlement hurts your credit. But bankruptcy hurts it more. A Chapter 7 filing typically drops your score by 150 to 250 points and stays on your report for 10 years. Settlement drops it by 50 to 100+ points (mainly from the missed payments) and the marks start aging immediately. Most of our clients see meaningful credit recovery within a year of completing the program. Many go on to buy homes within 2 to 4 years — which is often faster than the bankruptcy timeline allows.

The Numbers Side by Side

For someone with $35,000 in credit card debt:

Chapter 7 bankruptcy: Attorney fees of $1,500 to $3,500, filing fee of $338, debts discharged in 3 to 6 months. Total cost: roughly $2,000 to $4,000. Credit impact: 7 to 10 years on your report, 150 to 250 point initial drop.

Chapter 13 bankruptcy: Attorney fees of $2,500 to $6,000, filing fee of $313, plus 3 to 5 years of court-supervised repayment of a portion of your debts. Total cost: varies widely but could be $15,000 to $30,000 depending on your disposable income. Credit impact: 7 years on your report.

Debt settlement: Settlements at roughly 45% to 55% ($15,750 to $19,250 to creditors) plus fees of 15% to 25% of enrolled debt ($5,250 to $8,750). Total cost: roughly $21,000 to $28,000 over 18 to 36 months. Credit impact: temporary drop, recovery within 12 to 24 months of completion.

Chapter 7 is the cheapest option by far. But it comes with the most severe and longest-lasting credit consequences, it's public record, and not everyone qualifies. Settlement costs more out of pocket but preserves more of your financial life and reputation.

Chapter 13 is often the worst deal for consumers — you're in a court-supervised plan for 3 to 5 years, still paying back a significant portion of your debt, plus attorney fees. For many people, settlement accomplishes a better result in less time with fewer restrictions.

The Mistakes I See

Rushing to bankruptcy when settlement would have been less damaging. I've talked to people who filed Chapter 7 over $20,000 in credit card debt. That's absolutely solvable through settlement in 18 to 24 months. Now they have a bankruptcy on their record for a decade.

Avoiding bankruptcy when it's clearly the right answer. On the other end, I've seen people spend years making minimum payments on $80,000 in debt they'll never pay off, afraid of the "bankruptcy" label. That fear is costing them years of their life and tens of thousands of dollars. Sometimes the label is worth it.

Not consulting anyone before deciding. Both bankruptcy and settlement are complex financial decisions with long-term consequences. Making this call based on articles alone (including this one) is risky. A free consultation with a settlement company like ours takes 15 to 20 minutes and costs nothing. A bankruptcy consultation with most attorneys is also free. Get both perspectives and then decide.

Ignoring the tax implications. Forgiven debt through settlement may be taxable income (though the insolvency exclusion protects most of our clients). Discharged debt through bankruptcy is generally not taxable. For some people, this tax difference tips the scales. It's worth factoring in.

My Honest Framework

When someone calls us, here's roughly how I think about their situation:

Under $10,000 in debt: Probably try consolidation or aggressive budgeting first. Settlement fees on small amounts eat into the savings. Between $10,000 and $75,000 with some income: This is where settlement shines. We can usually create a realistic program that resolves everything in 2 to 3 years. Over $75,000 with limited income: Start with a bankruptcy consultation. The math may not work for settlement unless income is high enough to fund meaningful monthly deposits. Active lawsuits or garnishments: Talk to a bankruptcy attorney first for immediate protection. We can potentially settle accounts too, but bankruptcy's automatic stay is the fastest shield available.

These aren't hard rules — every situation has nuances. But it's the general framework I use, and I think it's more helpful than a generic "it depends" answer.

Frequently Asked Questions

Is settlement better for my credit than bankruptcy? Generally yes. Settlement causes a smaller initial drop and the marks begin aging immediately. Bankruptcy causes a larger drop and stays on your report for 7 to 10 years. Most settlement clients see meaningful credit recovery within a year of completing their program.

Can I file bankruptcy after trying settlement? Absolutely. If settlement isn't working — maybe a creditor is being unreasonable, or your financial situation worsens — bankruptcy is always available as a backup. Funds in your dedicated settlement account are yours and can be used to pay an attorney.

Do I need a lawyer for settlement? No. We handle the negotiations directly with creditors. However, if a creditor files a lawsuit during the process, you may need legal counsel for that specific matter, and we can help connect you with resources.

Which option is faster? Chapter 7 is the fastest — 3 to 6 months to discharge. Settlement typically takes 12 to 36 months. Chapter 13 takes 3 to 5 years and is the slowest option.

Will bankruptcy affect my job? Bankruptcy is public record. Most employers won't check, but some industries — financial services, government positions requiring security clearance — do. Settlement is private and doesn't appear on background checks.

What if I'm married? Settlement only affects the enrolled accounts. If the debts are in your name alone, your spouse's credit is not impacted. Bankruptcy can affect jointly held debts depending on whether you file individually or jointly.