Share

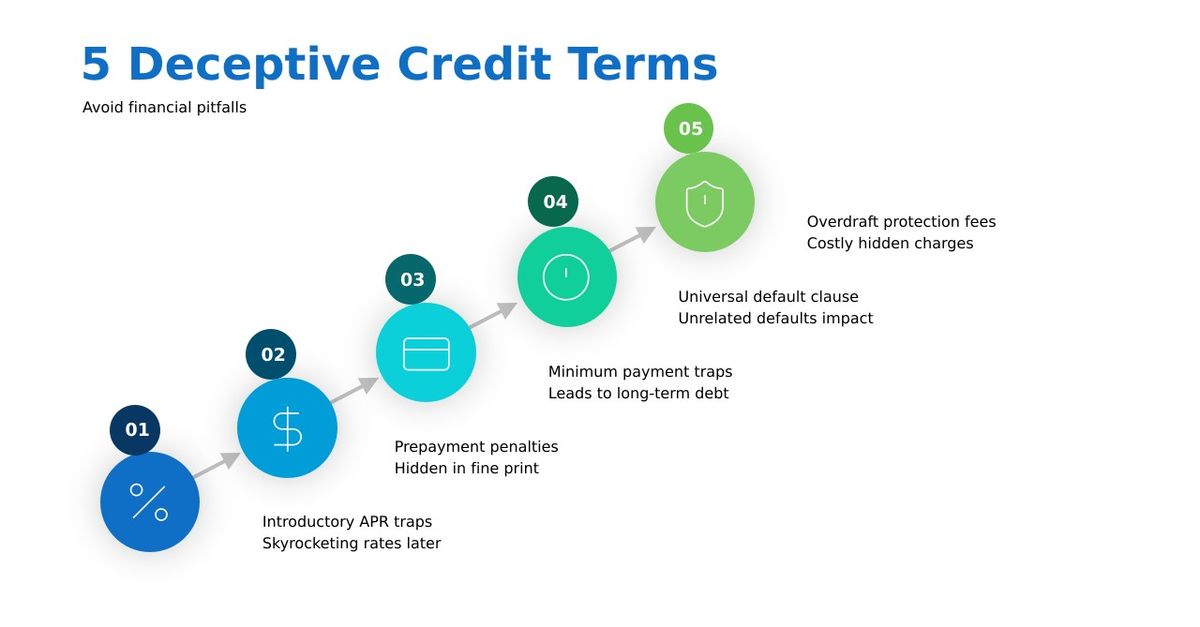

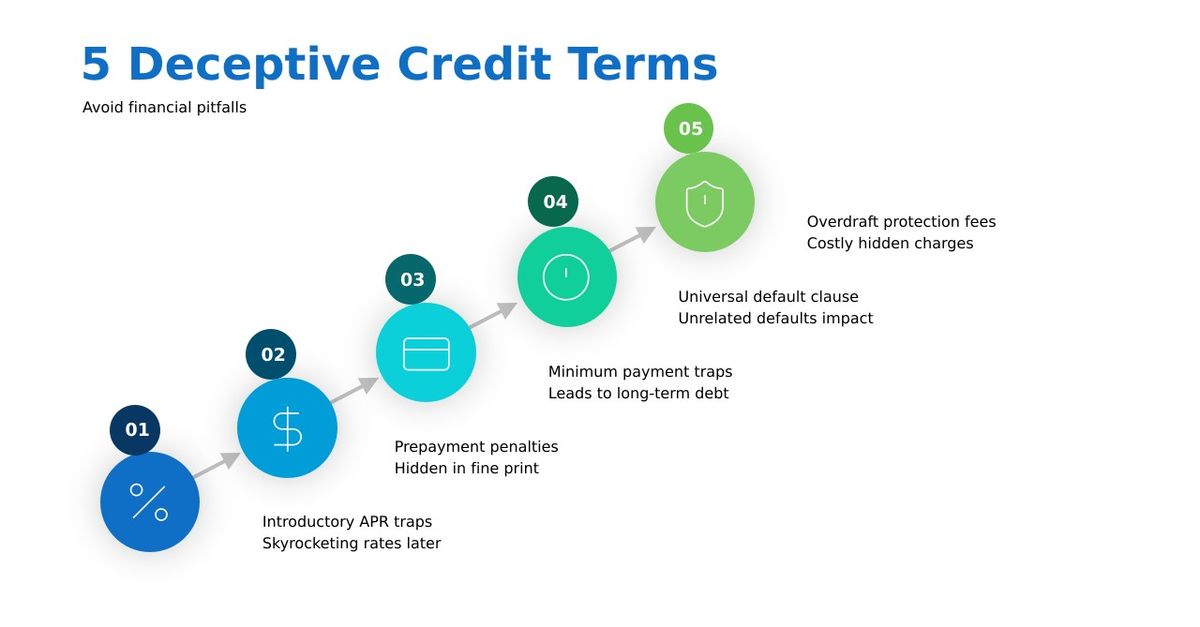

5 Deceptive Credit Terms to Watch Out For

The credit card industry and credit card companies in general tend to use some sneaky tactics and verbiage. In comparison, to other contracts, credit card contracts are often purposely deceptive and deceitful. They use terms that are superfluous and can really do some serious damage if you aren't mindful. At The Debt Relief Company, we specialize in helping Americans manage and eliminate high-interest credit card debt through effective debt consolidation and debt settlement strategies. Many consumers don't realize that a lack of understanding and the confusion brought about by deceptive terms terms can lead to unexpected fees, higher interest rates and all out inclination to a chaotic financial situation. Knowledge and understanding can really help you to avoid financial stress and save a lot of money. Here, we'll discuss the top five deceptive credit terms you should watch out for.

📊 “Predatory lending practices, including deceptive credit terms, cost Americans billions per annum and disproportionately affect low-income and minority communities.” Source

Key Takeaways

- Deceptive credit terms can lead to unexpected financial burdens.

- Understanding common credit terms can help you avoid pitfalls.

- Always read the fine print on credit card and financial agreements.

Understanding Deceptive Credit Terms

What Are Deceptive Credit Terms?

Deceptive credit terms are those tricky conditions and clauses hidden in the fine print of many different credit agreements. These terms are designed to mislead or confuse borrowers, making it easy for them to overlook important details that could cost them money in the long run. They often sound harmless but can have serious financial implications.

Why Should You Care?

Understanding these terms is crucial because they can lead to unexpected fees, higher interest rates, or other unpleasant surprises that can strain your finances. By being aware of these deceptive practices, you can make more informed decisions and better protect yourself from potential financial pitfalls.

Common Examples of Deceptive Credit Terms

- Introductory APR: Often advertised as a low or 0% interest rate, but it usually only lasts for a short time period before skyrocketing. Make sure to always check the fine print for retroactive interest as well. Failure to pay off the entire balance within the promotional period can lead to extra finance charges costing you a lot of money!

- Prepayment Penalties: Fees charged if you pay off your loan early, which are often not clearly disclosed. Nobody likes to get penalized for doing a good thing and paying down a loan early, always make sure to check if there are pre-payment penalties associated with your line of credit.

- Universal Default Clause: Allows creditors to increase your interest rates and decrease your credit availability if you default on any unrelated debt obligations. This is a double whammy for many consumers who already stuck in a bind and relying on credit card debt.

The Regulatory Framework

There are laws in place, like the Truth in Lending Act (TILA), designed to protect consumers from deceptive credit practices. These laws require lenders to disclose credit terms clearly and accurately and have helped consumers in the long term. However, despite these regulations, some lenders still find ways to obscure important financial details and use excessive jargon. Being well-informed and vigilant of what to look out for is your best defense against these deceptive types of practices.

Common Deceptive Credit Terms

Introductory APR

Many credit cards boast an introductory APR, often as low as 0%. Sounds great, right? Except, here's the catch: this low rate is only temporary. After a few months, that same interest rate can skyrocket to a much higher rate. Always check how long the introductory period lasts for and what the regular APR will be after it runs its course.

Prepayment Penalties

Some loans come with prepayment penalties, meaning you get charged for paying off your loan early. It’s akin to getting punished for being responsible. These penalties are often hidden in the fine print, so make sure to ask about them before signing any agreement.

Misleading Minimum Payment

Credit card statements often highlight the low monthly minimum payment amount. Paying just the minimum can often times seem manageable, but it can and will lead to long-term debt. This is also why it is more difficult to get out of debt when only paying the minimum payment. Since the remaining balance accrues daily interest, it could potentially cost you hundreds or thousands more in interest payments over time. That means that you are getting charged compounded interest every single day, even if you don't use your credit card.

Universal Default Clause

This sneaky clause allows credit card companies to increase your interest rate if you default on any loan, even if the two lines of credit are separate and unrelated. So, if you're late on a utility bill, your credit card APR could jump up tremendously. Always read the terms and conditions in these clauses since they can lead to very unforgiving financial charges.

Overdraft Protection Fees

Overdraft protection usually sounds helpful, but it can be quite deceptive. Instead of declining a transaction that exceeds your balance, the bank covers it and charges you a fee. These fees can add up quickly, sometimes costing more than the overdraft itself. It's essential to understand the terms and decide if overdraft protection is right for you.

Spotting the Red Flags of Deceptive Terms

Hidden Fees

One of the biggest red flags in credit agreements is hidden fees. These are often buried deep within the fine print and can include charges like processing fees, late payment penalties, or annual fees that weren't clearly disclosed in an upfront and clear manner. To avoid surprises, always ask for a detailed list of all potential fees before signing anything.

Ambiguous Language

Credit terms that use vague or confusing language can be a sign of deception. Words like "may" or "could" suggest that terms might change at the lender's discretion. If you encounter any ambiguous language, ask for clarification in writing. This way, you have a record of what was promised.

Aggressive Sales Tactics

If a salesperson is pushing you to sign quickly or discouraging you from reading the full agreement, take a step back. Aggressive tactics are often used to prevent you from noticing unfavorable terms. Always take your time to read and understand the agreement fully, and don't hesitate to walk away if something feels off.

How to Protect Yourself from Deceptive Credit Practices

Educate Yourself

Knowledge is your first line of defense against deceptive credit practices. Take the time to learn about common credit terms and what they really mean. This way, you won't be caught off guard by fancy wording or hidden clauses. There are plenty of resources online that can help you understand the basics of credit and loans.

Compare Offers

Don't just jump at the first credit offer you see. Instead, shop around and compare different offers. This will give you a better idea of what's out there and help you spot any red flags. Look beyond the promotional rates and focus on the long-term terms and conditions. This approach can save you from unexpected surprises down the road.

Utilize Credit Counseling Services

If you're feeling overwhelmed, consider reaching out to credit counseling services. These organizations can provide guidance and help you understand the fine print of credit agreements. They can also assist you in creating a plan to manage your debt effectively. It's a smart way to ensure you're making informed decisions about your credit.

The Role of Financial Institutions

Lack of Transparency

Many financial institutions are known for their lack of transparency when it comes to credit terms. They often hide important details in the fine print, making it difficult for consumers to understand the true cost of credit. This is not just a minor issue; it can lead to significant financial burdens for borrowers who are unaware of hidden fees and charges. For example, some credit cards advertise low introductory rates but fail to clearly disclose the high rates that apply after the introductory period ends.

Marketing Tactics

Financial institutions often use aggressive marketing tactics to lure consumers into signing up for credit products. These tactics can include misleading advertisements that emphasize the benefits of a credit product while downplaying its drawbacks. For instance, a loan might be advertised as having "no upfront fees," but the fine print reveals that there are substantial fees added to the loan balance. Such practices can easily mislead consumers, especially those who are not familiar with credit terminology.

Examples of Deceptive Practices

- Introductory APR Offers: These are often advertised as 0% APR but come with conditions that are not clearly explained, such as a short duration or a high penalty APR if a payment is missed.

- Overdraft Protection: This is often marketed as a service to help consumers avoid declined transactions, but it can result in hefty fees that exceed the amount of the overdraft itself.

- Universal Default Clauses: Although less common now due to regulatory changes, some credit agreements still include clauses that allow lenders to increase interest rates based on changes in a consumer's credit score, even if they have not missed any payments.

Regulatory Efforts to Combat Deceptive Practices

Truth in Lending Act (TILA)

The Truth in Lending Act (TILA) is a significant piece of legislation aimed at protecting consumers from deceptive credit practices. TILA requires lenders to disclose all credit terms clearly and transparently, ensuring that borrowers understand the full scope of their credit agreements. This includes details like interest rates, loan terms, and any hidden fees. The goal is to prevent lenders from misleading consumers with confusing or ambiguous language.

Role of the Federal Trade Commission (FTC)

The Federal Trade Commission (FTC) plays a crucial role in monitoring and enforcing regulations against deceptive credit practices. The FTC is tasked with investigating complaints and taking action against companies that violate consumer protection laws. They work to ensure that businesses adhere to fair lending practices and that consumers are treated fairly. The FTC's efforts have led to numerous settlements and penalties against companies engaging in fraudulent or misleading activities.

Consumer Financial Protection Bureau (CFPB) Initiatives

The Consumer Financial Protection Bureau (CFPB) is another key player in the fight against deceptive credit practices. The CFPB develops guidelines and policies to protect consumers from unfair lending practices. They also provide resources and education to help consumers make informed decisions about credit. Through their initiatives, the CFPB aims to create a more transparent and fair credit marketplace.

The Long-Term Impact of Falling for Deceptive Credit Terms

Financial Stress and Debt

Falling for deceptive credit terms can lead to a cycle of debt that is hard to escape. Many people find themselves paying much more than they initially expected due to hidden fees and unexpected interest rate hikes. This can result in significant financial stress, affecting not just your wallet but also your overall well-being. Over time, the accumulated debt can become overwhelming, making it difficult to manage monthly expenses and potentially leading to bankruptcy.

Credit Score Damage

Your credit score is a crucial factor in determining your eligibility for future loans and credit cards. If you miss payments or incur high levels of debt due to misleading credit terms, your credit score can take a significant hit. A lower credit score means higher interest rates on future loans, which can cost you thousands of dollars in the long run. It's a vicious cycle that can be hard to break.

Examples of Deceptive Practices

- Introductory APR Offers: These offers often come with low initial rates that skyrocket after a few months, catching consumers off guard.

- Overdraft Protection Fees: These are often marketed as a safety net but can lead to hefty fees that exceed the overdraft amount itself.

- Universal Default Clauses: These clauses allow creditors to increase your interest rate if you default on any loan, even if it's unrelated to the credit card in question.

Debunking Myths About Credit Terms

When it comes to credit terms, there's a lot of misinformation floating around. Many people believe that if a deal sounds good, it must be good. But that's not always the case. Here are some common myths and the reality behind them:

Myth: "Low monthly payments mean a good deal." Reality: Low monthly payments often mean you'll be paying for a longer time, which can result in higher overall costs. It's a tactic used to make offers seem attractive, but the total payment could be much more than you expect.

Myth: "All lenders disclose everything upfront." Reality: Not all lenders are transparent. Some hide important details in the fine print, expecting that most people won't read it. This can lead to unexpected fees and charges down the line.

Myth: "Overdraft protection is always beneficial." Reality: Overdraft protection can lead to hefty fees that might exceed the overdraft amount itself. It's important to understand the terms before opting in.

It's crucial to read the fine print and ask questions whenever you're dealing with credit terms. Don't assume that what's advertised is the whole story. Taking the time to understand the details can save you from unexpected surprises and help you make informed decisions.

Why Choose The Debt Relief Company for Your Debt Solutions?

The Debt Relief Company has successfully helped thousands of Americans eliminate high-interest credit card debt by consolidating all their debts into one low monthly payment.

Our debt consolidation services are tailored to meet your unique financial situation, providing you with a clear path toward debt-free living.

Learn more about our approach and how we can assist you by visiting our About Us page.

👉Book an appointment today to start your journey towards financial freedom.

Frequently Asked Questions

What are the most common deceptive credit terms to avoid?

Some of the most common deceptive credit terms include introductory APR offers that change after a few months, prepayment penalties hidden in the fine print, and minimum payment options that can lead to long-term debt. It's important to read all terms carefully and ask questions if something isn't clear.

How can I identify hidden fees in a credit agreement?

To spot hidden fees, always read the fine print of any credit agreement. Look for terms like "service charge," "maintenance fee," or "processing fee." These might indicate additional costs. Also, ask the lender to provide a full list of fees in writing before you agree to anything. Just like hidden fees some consumers also have hidden bank accounts.

What legal protections exist for consumers against deceptive credit practices?

Consumers are protected by laws such as the Truth in Lending Act (TILA), which requires lenders to disclose all credit terms clearly. The Federal Trade Commission (FTC) also works to prevent unfair or deceptive practices. If you feel a lender has misled you, these laws can be a basis for legal action.

Are there tools to compare credit products effectively?

Yes, there are several online tools and resources that can help you compare credit products. Websites like Consumer Financial Protection Bureau offer comparison tools that allow you to see different credit offers side by side, helping you make informed decisions.

How does the Truth in Lending Act benefit borrowers?

The Truth in Lending Act ensures that borrowers receive clear and complete information about credit terms. This means you can compare different credit offers more easily and understand the true cost of borrowing. It helps prevent surprises by requiring lenders to disclose all terms upfront.

What are some examples of deceptive credit terms?

- Introductory APR offers that change unexpectedly.

- Prepayment penalties hidden in loan agreements.

- Minimum payment options that lead to higher long-term costs.

How can I protect myself from deceptive credit practices?

- Always read the fine print and ask questions.

- Use online tools to compare credit products.

- Educate yourself about common credit terms and their meanings.

What should I do if I suspect a lender is using deceptive practices?

- Document all communications with the lender.

- Report the issue to the Consumer Financial Protection Bureau.

- Consult with a legal advisor to understand your rights.