Share

How the Coronavirus Pandemic Will Impact Your Credit Worthiness

Credit Pre-COVID and Post-COVID Impact on US Consumer Credit Worthiness and Personal Finances

The coronavirus pandemic has brought a great deal of economic uncertainty to the United States and world economies alike. Along with the change in how everyday people move from place to place and how our economies function on both a macro and micro level, changes to consumer credit worthiness and credit portfolios are all happening at an exceedingly rapid rate.

So, what exactly is happening to the credit scores of American citizens and their lines of available credit during this pandemic? Well, unsurprisingly, banks and credit issuers are tightening their belts on Americans.

However, before we get into the specifics of what is happening to our credit and what will inevitably happen as we progress through this pandemic, let’s first lay down some perspective.

The Credit Bubble Leading Up to the COVID Pandemic

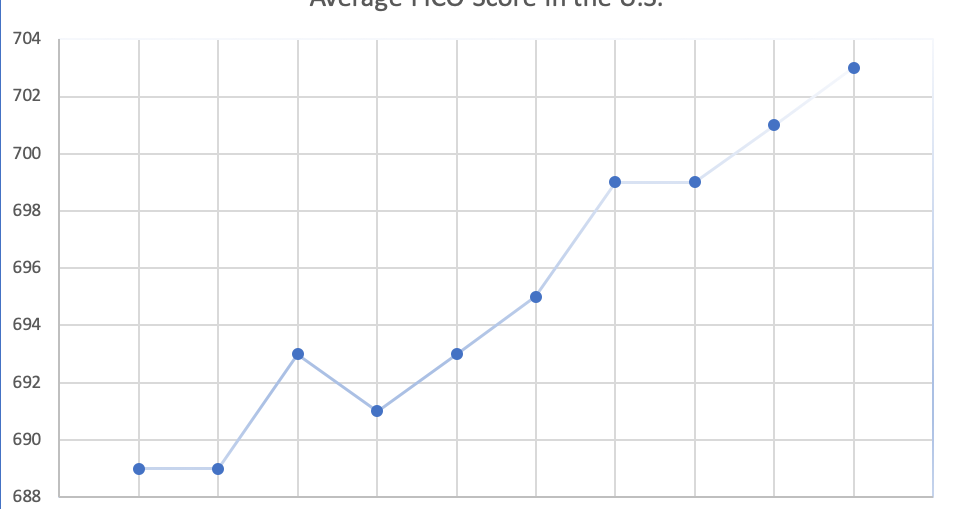

At the end of 2019, Experian released a report showing that US FICO scores hit a new all-time high

Data Sourced from Experian

The Experian report shows that the average American FICO score hit a new all-time high at the beginning of 2020. The average FICO score for an American citizen now stands at 703 compared to 689 from the decade prior.

Wow this is great news! Right?

Well not exactly…

If the credit worthiness of Americans is the highest it’s ever been, it would be safe to assume that we as a people are prospering financially. However, that is definitely not the case here.

Our company would actually argue the opposite. Banks have been steadily increasing our lines of available credit in a financially irresponsible way, just in the hopes that we make use of leverage we do not actually need so that they can collect more in interest payments from us.

We have been here before. At the end of the day, banks, credit card companies, and lenders are not held accountable for their actions. The banking industry barely innovates and provides little value add to American society. Moreover, if a pandemic or crisis were to arise, they have the Federal Reserve to hold their hands and help keep them afloat via bailouts.

Talk about having it made.

On the other hand, us everyday people have to work for everything we get. We don’t have the luxury of lending out deposits that were not ours to begin with and we definitely don’t have the luxury to charge others for the use of those funds. (middle man much?)

Moreover, credit scores never were and never have been designed for consumers. Your credit worthiness is meant to determine your ability to repay what you borrowed (in layman’s terms it’s supposed to be an assessment of your financial responsibility and whether you will pay back what you borrowed on time).

Why Were Credit Scores at All-Time Highs?

Experian claims that the reason scores have hit an all-time high is due to the fact that Americans as a whole have been better at making on time payments on their debt obligations.

However, debt has also increased as a whole, as have credit balances and utilization rates. So, as our utilization of credit has increased, credit card companies have been increasing our credit availability to compensate and offset the impact to our scores.

Don’t believe me? Try getting an increase in your credit limit. It’s quite possibly one of the easiest things to do—as long as you are current on all your payments. There is no method for income verification and little to no compliance or due diligence involved in the process.

In fact, most credit card companies automatically raise your limit without even asking you nowadays in an attempt to feed consumers caught in the vicious cycle of credit card debt. It’s possible they’ll ask for your updated income every once in a while, BUT this literally requires no verification on your part. You can put your income as $300,000—whether it’s true or not—you are EXTREMELY likely to get an increase in your credit limit.

This is financial irresponsibility 101. However, the difference is that banks and lenders are fully aware of this and as the balances have increased, so have the credit limits. So, besides our credit scores, what else is at an all-time high might you ask?

Consumer Debt Also at All-Time Highs

If you guessed consumer debt, you would be 100% correct. Household debt for Americans in aggregate reached an all-time well before the beginning of the coronavirus pandemic.

Prior to the lockdown, the New York Fed just recently reported that total household debt increased by $193 billion or 1.4 percent to reach $14.15 trillion in the fourth quarter of 2019, well surpassing what it was during the real estate bubble prior to the Great Recession. Credit card debt totals are also near all-time high and are likely to increase moving forward—as the coronavirus pandemic continues to leave millions jobless and in a lower income bracket.

So, what exactly is going on here? Well a couple things actually…

First, our credit scores have become extremely bloated—as a whole. Everyone loves having great credit and for good reason. Our credit scores have become a source of pride for many, whether our scores are based in reality is neither here nor there.

We love having great credit. We brag about our scores to our friends and family and we wear those 800 credit scores with a badge of honor.

Second, we have become quite adept at using the credit system to our benefit—in order to attain the best possible score. There are entire industries built on taking advantage of credit scoring algorithms and providing quick boosts to your credit score. It’s all a game, but who is actually being played in this game is still to be determined.

The Change in Perceived Credit Risk

Credit scores and the algorithms used to derive who is and who isn’t a good credit risk have shifted away from the rational. The scoring system is now favoring those with the most diversified lines of credit and whether they make timely payments.

Now this is great and all, and our credit worthiness should be determined by these factors but to what extent? If we are carrying substantially more debt than we did 10 years ago are we REALLY more creditworthy?

Our current credit system is showing that even if the terms of your lending products aren’t great and you’re paying excessively high interest rates—as long as you have a diversified credit portfolio and make on time payments—you will have better credit for it.

Is this truly a good way to gauge the credit standing of a particular individual?

We say it is not.

Credit worthiness has shifted away from determining who is a good credit risk and shifted towards who will pay the most interest on high interest loan products. Or who has automatic payments set up on all their diversified portfolio of loan products.

Why is this good for banks? Well, for every $1,000 you owe to your bank, the effect of compounding interest becomes that more formidable. During a pandemic, like the one we are currently experiencing, the money you’re spending on that interest could make or break your finances for years to come.

Utilization rate is a significant factor when determining your credit score and by perpetually increasing said utilization rate, it once again appears that credit card companies have found a way to milk average Americans for all they have by enticing us with never-ending lines of credit.

Credit scores do not take into effect your debt to income ratio (quite possibly the most important factor when determining an individual’s credit worthiness). Maybe it’s time we moved towards a more accurate scoring system and one that actually considers your ability to repay your obligations not your ability to make high interest minimum payments and bolster bank profits.

How are Banks and Lenders Altering Credit Opportunities Due to the COVID Pandemic?

Remember those bloated credit limits and lines of credit banks were providing everyone in late 2019 and early 2020? Yea me neither. That’s’ because they’ve essentially evaporated.

Due to the coronavirus, lenders have begun tightening all forms of credit extension. The qualifications and requirements for mortgage origination have increased dramatically since the pandemic. Additionally, both credit score and debt to income requirements have seen dramatic increases.

Credit card companies have also begun lowering limits and have already raised credit perimeters on acquiring a home or qualifying for other financial products. We should expect these declines in credit availability to get worse in the coming months, not better!

Discover has just stated it has begun to reign in consumer credit limits and available lines of credit.

In the same vein, the CEO of Synchrony Financial—known for being the credit servicer on accounts like Walmart, Amazon, Lowes, PayPal Credit—recently stated the company will use the entire scope of compiled consumer credit data available to them in order to “dynamically reevaluate a customer’s creditworthiness”. Data that was often neglected when determining our credit scores prior to the pandemic.

The worst part—all of this is occurring while consumers need credit availability the most.

For the latter part of the decade, credit ratings have been extremely bloated. This was simply the case because it served to better the bottom line of all banking institutions. In many cases, credit limits were raised 50% Year over Year without requests to do so. Credit card companies raised limits to profit off US consumers, even when they weren’t asking for increases in credit availability. Now that the tables have turned they will do the opposite as it yet again serves to protect their liabilities and discontinue lending when American consumers and small businesses need it the most.

What else has changed since the pandemic?

A recent research report by Mike Brown of LendEDU shows that consumer related finance complaints with the CFPB have skyrocketed since the onset of coronavirus pandemic. Credit related complaints were up 84% YoY with the CFPB.

The TDRC team has seen the same occur with many of our own clients. Many were wrongfully marked as delinquent when they were in fact simply deferring payments as allowed by the CARES Act.

At some point this is really akin to beating a dead horse. Consumers should not have to deal with limits being slashed with no just cause and then have to deal with disputing wrongful credit reporting at the same time.

So, what does this mean for the average consumer and what can we do to protect ourselves?

Well, it means we should expect our total credit availability to decrease as a nation, in aggregate and should not be slow to better our financial health.

What Can You Do to Protect Your Personal Finances During the Pandemic?

Stop relying so heavily on credit.

Lines of credit can be an extremely useful tool for a multitude of reasons, but if we can avoid using credit for things we really don’t need our financial health will be all the better for it. This sounds simple but just try using your cards less.

Stop keeping your money in a savings account if you have high interest bad debt.

This includes: personal loans, credit cards, unsecured lines of credit, etc. Nothing irks me more than this! If you have $3,000 in savings and $2,000 in credit card debt, you should immediately use your savings to pay off the stressful credit card debt.

In what world is it to your benefit to earn 1.25% interest on savings and pay 20% interest on revolving credit card debt? This is an ill-gotten myth and fallacy that has been perpetuated by the personal finance community for some time now.

"Financial experts” that say you should keep an emergency fund in your bank account when you have high interest debt are just plain WRONG. This is never to your benefit.

Why is this false? Well, you are losing money both ways. First your bank is lending out your savings for much more interest than you are receiving and second you are not properly using the opportunity cost of your money. It never makes financial sense to pay 20% in interest when you have that money just sitting in your account accruing little to no interest.

Try to rely less on banks and credit card companies.

We as a society, need to stop assuming that lenders will always provide a cushion of credit opportunities for us. They won’t bail us out if we need them, if anything, expect the opposite to occur.

The old credit adage: “If you don’t need it, you definitely qualify” could not be more apparent here. Banks want to lend and provide credit to individuals that don’t need the credit extension or leverage. Nothing new here at all. This is why we should stop assuming that there will always be an available line of credit for us.

This adage could not be more apparent when referencing debt consolidation, a process most consumers don't usually understand. At The Debt Relief Company, we see it all the time. The individuals that get denied for debt consolidation loans are typically the ones that need it the most. Meanwhile if you have little to no unsecured debt, you would easily qualify for a debt consolidation option. This is financial nonsense at its finest.

How Will the Economic Lockdown Change Our Credit?

We at The Debt Relief Company feel the US is currently in a credit bubble and the COVID pandemic may just be the thing to pop it.

So, before you decide to weigh the value of your credit score in gold, maybe take the time to notice that Cash truly is King. An 800 credit score will not keep you safe in an economic crisis but some cash definitely will.

The real issue that lies here is that lenders have raised our credit availability to exorbitant levels for little to no reason at all. YES, we as American consumers need to be more responsible in regards to our finances but the banks surely are not helping make that any easier.

The psychological impact of having $20,000 in available credit on just one credit card can profoundly change our psyche and spending habits. It tends to lead to emotional spending. Yes, it’s our available line of credit but at the end of the day it’s not our money and not something that we should ultimately depend on.

It’s akin to the wealth effect seen from prices increases in the stock market. Should we spend more just because our 401k balance has seen a significant increase in value? No, we most definitely should not.

Although the growth in assets prices and our portfolio is material it’s an untouchable asset for many. The same can be said for the value of our homes. Although we feel wealthier when we see our home values increase (and we technically are), this doesn’t mean we should adjust spending to account for that new-found wealth. For the average American, these assets are only long-term investment vehicles—not something we should depend on for sustenance.

We are living in uncertain times. So, the next time you see an increase in your credit score and credit limit, try to think nothing of it. It won’t last when things get tough and your main priority should always be to pay down bad debt. After that, look towards saving for the future, so that you don’t need to rely on the house of cards our credit system is currently built on.

***This article is not meant to be anti-banking. It’s just meant to ask the questions that often go overlooked and provide some thought leadership into why things are the way they are—and if anything, try to provide an avenue for change.